In the ever-evolving financial world, understanding your clients, personalizing services, and automating operations are no longer options; they are necessities. If you're still relying on outdated methods, you're not only wasting time but also losing opportunities.

Picture this: you're stuck late at the office again, sifting through piles of paperwork, manually entering data, and struggling to understand your clients' unique needs. The frustration builds as you realize your competitors are thriving.

...Imagine the hours wasted manually directing potential clients to appropriate advisors within your firm. The process is slow and error-prone, causing confusion and delayed response times. Meanwhile, competitors with automated routing ensure immediate and personalized client interactions. The inefficiency looms large, and you feel the pressure of modern demands.

...Visualize the endless hours you're spending trying to prioritize clients without clear criteria. Your competitors are utilizing AI-powered lead scoring, effortlessly aligning their strategies with client needs. The frustration escalates as you're still stuck in guesswork, losing both time and potential profits.

...Picture the struggle of manually trying to optimize your outreach through endless trial and error. You juggle emails, landing pages, and formats, yet the results fall short of expectations. Your competitors are thriving with A/B testing, fine-tuning their approaches with data-backed insights. The gap between your operations and this streamlined efficiency feels overwhelming, and the need for change is clear.

...think about this: you've just missed another potential client due to inefficient client routing. While you're tangled in manual sorting, the opportunity slipped through your fingers, and your competitors reaped the benefits. The realization hits hard; there must be a better way.

...Envision a disheartening review from a lost client who found your website lacking targeted content and effective SEO. While your competitors are reaching prospects online with tailored financial advice, your site remains hidden. The fear of becoming irrelevant in the digital age creeps in as you recognize the widening gap between your practices and modern expectations.

Imagine a world where you have a profound understanding of your client base, can offer tailored services, and have automated workflows to handle routine tasks. Your clients are happy, your team is efficient, and your business is growing

You may think that embracing data analytics and modern tools is complicated and costly. But what if the real barrier is clinging to outdated beliefs and practices? It's time to let go of the old ways and embrace a new, data-driven approach.

Introducing AI Transformation for Financial Advisors

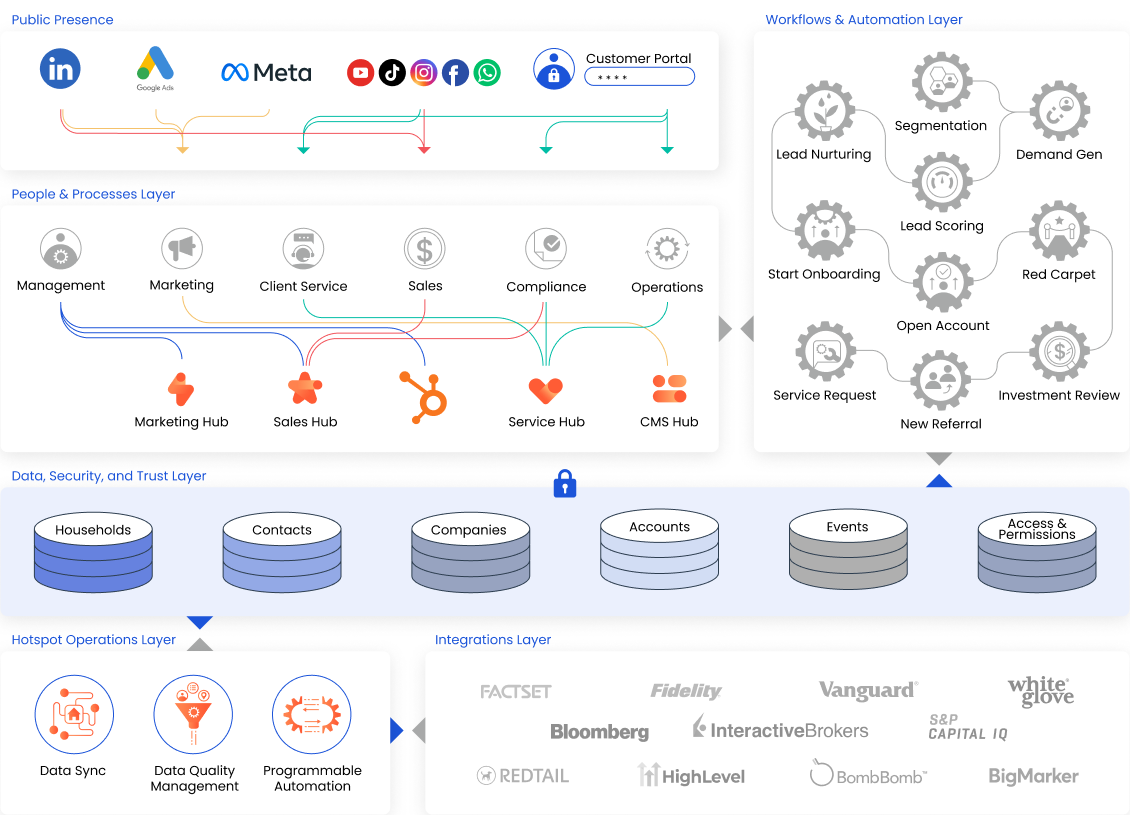

A comprehensive set of tools, processes, solutions for wealth management to increase AUM, reduce operational costs and risks, and increase client satisfaction.

Powered by HubSpot

Lead Gen @ Scale

AI-powered automation that attracts and segments your leads with personalized outreach through SMS, Email, and Social. Never let another opportunity slip through your fingers.

Onboard in Style

Don't let your clients or your team suffer through another set of paper forms. Embrace digital onboarding and let clients know you know how to serve them securely and efficiently.

Automate your tasks

Existing clients are the best source of AUM growth. Focus on nurturing these relationships and automate away the administration, including sending Welcome and Birthday gifts by mail (Yes, we can do that!).

The Big Picture

A fully connected platform that provides a 360 Command Centre of your marketing channels, pipeline, clients, operations, and everything in between. This is a high ROI and quick time-to-value solution.

The platform comes packed with pre-configured playbooks, workflows, and reports with best practices baked in. These best practices are built by industry veterans and can be customized to each advisor to suit their own unique niches.

It all starts with your own vision of the future and how you want to provide an exceptional client experience. We are just here to enable and guide you along that journey.

The Lead Gen Engine

Hunt with a spear but with the coverage of a net.

No one opens cold emails or answers cold calls anymore. Your outreach has to be authentic yet personalized, multi-channel yet channel appropriate. Most importantly, it has to yield results and be compliant.

While there are several digital marketing agencies out there, they all solve one piece of the puzzle, leaving you to assemble all the pieces yourselves.

With HubSpot's comprehensive CRM platform and Learners.ai's customizations for financial advisors, all your lead generation can live, grow, and get smarter all in one platform that connects and orchestrates all your specialty apps together.

.png)

The Art of Closing

Pipeline automation with a powerful CRM.

When you have a clear view of your pipeline with all your administrative tasks, email sequences, and grunt work is automated away, you can truly start to understand where the bottlenecks are to achieving predictive, sustainable growth.

With years of industry experience and input from 100+ financial advisors, we have converted the sales process into a science. But closing a deal requires trust and a strong relationship, which is truly an art, and not something that can be automated.

We do the science really well so you can focus on your art.

Digital Client Onboarding

Turn your bottleneck into an opportunity to delight.

No one likes filling out paper forms or entering data in manually. It is now possible to extend the functionality of HubSpot's powerful CRM to gather information directly from prospects through secure forms or through a secure client portal.

We have forms pre-built with most of the data required by Fidelity for opening accounts, and able to customize and integrate it with any other platform.

When a client knows from Day 1 that you are trying to make their lives easier, you're off to a good start.

-1.png)

Manage Households & Accounts

Single login and source of truth.

Go beyond the contacts and see the relationships between your contacts and what assets and accounts you are managing for them. Our solution comes equipped to handle integrations with your book of records or accounting and custodian platforms to update valuations in HubSpot.

No need to switch screens or scramble to find the right data when a client calls in. With HubSpot's integrated calling, the contact record pulls up as soon as the phone rings.

Reviews & Referrals

Strong compliance with a great client experience.

Annual reviews should not be a source of anxiety, but a window of opportunity. Automate the administrative work and trigger automatic investment review meetings with a smooth, secure, and compliant process for clients.

Turn your clients into advocates, encourage and reward them to bring in more referrals with the best source of marketing: a satisfied customer. Nurture your best sources of referrals and shower them gifts every time they help close business.

From self-service portals, chatbots, or in-person meetings, we help you connect and service your clients the way they want you to service them.

.png)

Attribution & Analytics

Know exactly what each dollar earns.

It is your job to make prudent financial decisions for your clients, and we help you make prudent decisions for your business. See clear attribution on how each dollar spent on marketing and sales converts to revenue.

From the simplest to the most complex revenue attribution models out there, our team has the expertise to take your tracking and analytics to the next level and turn your data into gold.

Never spend another dollar without knowing the expected return.

Built by Industry Experts

At Learners.ai, we're not just a collective of tech enthusiasts; we are CFA Charterholders, financial services practitioners, seasoned RevOps Consultants, data scientists, Solution Engineers, and full-stack developers. With over 40 years of combined hands-on experience, we're reshaping the Wealth Management industry through a data-driven, AI-powered lens, spanning marketing, sales, client success, operations, and compliance.

"WealthTech in a Box" is crafted with a deep understanding of the industry's distinct challenges and opportunities, focusing squarely on enhancing client relations, efficiency, and profitability. Our expertise isn't theoretical; it's forged from real-world experiences, with a team devoted to solving pressing issues in financial advisory services. Our aim? To deliver a solution that not only meets but exceeds your expectations.

Our Happy Customer Testinomials

Ashley Camire

Owner and Relationship Specialist

POQFL.com

I chose Learners for our CRM implementation because of their experience, CRM expertise, RevOps expertise, competitive pricing, and their focus on customer service. They provided a full audit of our CRM and then a complete overhaul of our CRM, from custom objects & properties, to completely new sales pipelines, workflow automation, lead scoring, reports & dashboards. I would absolutely recommend Learners - they are outstanding and are true experts. They take a true team approach to the project and are very flexible.

Cynthia LaRue

VP Marketing at ShipHero

Our team is using Learners.ai for a fairly complicated reimplementation of our HubSpot CRM and Marketing Hub. That said, working with them has been wonderful. They're basically a part of the team now! I never have any issues reaching out to them and receiving a reply, and a solution to whatever issue I've discovered. We've been working together for approximately three months and it's been nothing but wonderful. Projects like this are tough and time-consuming, but Learners.ai has continuously been up to the task and handled any and all of our requests. Shout out to Learners team! They've been terrific.

Brandon Palmer

Digital Marketing Manager at ShipHero

Learners did a fantastic job of understanding our perspective and at customizing an approach that met our needs, while still bringing much needed experience, structure and vision to our process. They clearly know their stuff when it comes to leveraging automation capabilities for financial services practices. It’s eye opening what automation can accomplish for our practices already, and I firmly believe that any RIA that hopes to stay relevant in the next decade ought to be investing in this critical area of technology NOW!

Jamal M.

Main Street Financial Solutions

Love working with the team at Learners! From day one, they really got our business and took the time to deliver a custom solution that our whole team can get behind!

Chris G.

Forum Financial Management, LP

Learners.ai has been an incredible partner for our HubSpot CRM rebuild and integration project. This has been a complex project completely rebuilding our CRM processes and workflows from the ground up while integrating numerous internal and external data sources. They have been incredibly responsive and provided great advice and best practices along the way. I'd definitely recommended working with the Learners team. Thank you!!

Brett Oliveira

ShipHero Sales

The Process

Discovery

A dedicated team of Learners will conduct a thorough analysis of for your current and design a target operating model, or future state, in collaboration with your leadership.

Implementation

We present our SOW, plan and mobilize the project, then get to work. Our weekly sprints and agile delivery methodology ensures your users and stakeholders are engaged.

Ongoing Services

Ongoing strategic, tactical, and operational support available through bespoke packages designed to fit your unique requirements.

The Product Tour

"WealthTech in a Box" is more than just a tool; it's your new way of doing business. Say goodbye to manual processes and generic offerings. Say hello to personalized services, operational efficiency, and satisfied clients.

HubSpot Onboarding

We are experts at customizing all the Hubs for Wealth:

- Marketing Hub

- Sales Hub

- Service Hub

- Operations Hub

- CMS Hub

CRM Migration

Get your data right from day one:

- Data Extraction

- Data Transformation

- Data Enrichment

- Data Migration

- Custom Data Models

- Import/Export Pipelines

Marketing Strategy

A comprehensive game plan:

- Setup Target Personas

- Customer Journey Mapping

- Editorial Calendar

- Email Templates

- Landing Pages & Forms

- Social Media & Ads

Marketing Automation

Putting your game plan into action:

- Lead Capture workflows

- Prospect Nurturing workflows

- AI-powered Lead Scoring

- Client Nurturing campaigns

- Simplified MarTech stack

Sales Strategy

A proven playbook:

- Sales process optimization

- Pipelines & Goals

- Deal Stages & Probabilities

- Prospecting Toolkit & Cadences

- Revenue Forecasting

Sales Enablement

Your playbook on autopilot:

- Built-in Email & Meetings sync

- Phone, SMS, Webinars sync

- LinkedIn Sales Navigator sync

- Task Queues & Automation

- Mobile app

Client Service

Not just a CRM, but a platform to deliver great client experience:

- Client Portal

- Service Tickets

- AI-powered Chatbots

- Knowledge bases

- Customer Satisfaction Surveys

Operations & Compliance

Get your data right from day one:

- User Audit Logs

- Role Based Permissions

- Rules Based Notifications

- Client Communication Tracking

- Advisor Activity Tracking

- Digital Forms & eSignatures

Training & Adoption

You are not on your own. We offer:

- Dedicated team

- Hands-on Workshops

- Custom training sessions

- Videos & User Guides

Reporting & Analytics

Your single pane of glass for:

- Marketing channel performance

- Revenue attribution

- Advisor Team Performance

- Sales Velocity by Segment

- Service Team Performance

- Customer Satisfaction Score

Discover the features of "WealthTech in a Box" that will transform your wealth management practice into a highly personalized, efficient, and profitable business. Say goodbye to manual processes and generic offerings. Say hello to personalized services, operational efficiency, and satisfied clients.

FAQ

The Upgraded FAQ

01

What exactly is WealthTech in a Box

WealthTech in a Box is a comprehensive solution designed to modernize and streamline your financial advisory operations. It encompasses a range of tools and services that automate essential processes, enhance client engagement, and enable data-driven decision-making, allowing you to focus more on client service and less on administrative tasks.

02

How can WealthTech in a Box help my advisory practice?

03

How easy is it to integrate WealthTech in a Box with my existing systems?

The integration process is designed to be smooth and straightforward. We are HubSpot Accredited custom integrations experts with decades of experience in tackling all sorts of integration challenges. WealthTech in a Box can seamlessly integrate with a variety of systems. To name a few, it can integrate with Fidelity, REDTAIL, BigMarket, Bloomberg, FactSet, Interactive Brokers, Vanguard, and S&P Capital IQ. Our team provides full support during the integration process to ensure minimal disruption to your operations.

04

What kind of support and training are provided with WealthTech in a Box?

We offer extensive support and training to ensure you and your team are well-equipped to make the most out of WealthTech in a Box. Our team comprises HubSpot Certified Professional Trainers with years of experience in practice management and coaching. We provide comprehensive onboarding training, live and video workshops, and ongoing educational resources to keep you updated with the latest features and best practices. Our aim is to provide a supportive environment that enables your practice to thrive using WealthTech in a Box.

Perfect For You If

"WealthTech in a Box" is perfect for you if you're a financial planner or wealth manager who wants to leverage data-driven decision-making to grow your practice.

…Independent Financial Advisors: Struggling with client segmentation and lead routing? Automate and streamline these processes to focus on what you do best – guiding financial decisions.

…Wealth Management Firms: Need to enhance client interaction and reduce manual data entry? Implement tailored content strategies, automated email campaigns, and a seamless CRM integration for a more efficient operation.

…Marketing Professionals in the Financial Sector: Looking to optimize your outreach? Utilize A/B testing and performance analytics to connect with potential clients in the most resonant way.

...Financial planners and Consultants: Want to prioritize your clients more effectively? AI-powered lead scoring takes the guesswork out of client prioritization, allowing you to focus on the most promising prospects.

…Operations and RevOps Specialists within Financial Services: Fed up with disconnected tools and platforms? "WealthTech in a Box" offers an integrated approach, using years of experience in business process redesign, RevOps, and digital transformation, to increase revenue and reduce expenses.

…Financial Technology Enthusiasts and Full-Stack Developers: Interested in the intersection of finance and technology? Gain insights into the latest in customization, integration, and automation specific to the financial planning industry.

…Financial Practice Managers Aiming for Growth: Seeking to scale your practice without losing the personal touch? From personalized content to digital onboarding flows, "WealthTech in a Box" offers solutions tailored to your growth ambitions.

This powerful integrated approach offers something for various professionals within the financial planning and wealth management industry, making it a comprehensive solution to common pain points.

Ready to learn more

On the call, we’ll review your integrations and identify any that need updating to keep working. Our team can give you an estimate of the amount of work required to make the changes.